Home Renovation Loan for Dummies

Table of ContentsWhat Does Home Renovation Loan Mean?The 6-Minute Rule for Home Renovation LoanGetting The Home Renovation Loan To WorkIndicators on Home Renovation Loan You Need To KnowHome Renovation Loan Can Be Fun For Anyone5 Simple Techniques For Home Renovation Loan

If there are any type of overruns, you'll have to spend for them yourself. That's why we advise putting money apart. You'll also need to reveal invoices for the work and submit a last examination record to your banks. Last but not least, you may wish to acquire finance protection insurance coverage to minimize the dimension of your down repayment.Refinancing can be beneficial when the improvements will add value to your home. By raising its worth, you increase the likelihood of a return on financial investment when you sell. Like all financing choices, this set has both advantages and drawbacks. Advantages: The rate of interest price is typically reduced than for various other kinds of funding.

As with any line of credit, the money is available at all times. The rate of interest are typically lower than for numerous other kinds of funding, and the passion on the credit history you've utilized is the only thing you have to be sure to pay monthly. You can use your line of credit for all kinds of tasks, not simply remodellings.

The 7-Minute Rule for Home Renovation Loan

Benefits of a personal line of credit scores: A debt line is adaptable and offers fast accessibility to cash. You can restrict your monthly repayments to the rate of interest on the credit rating you have actually used.

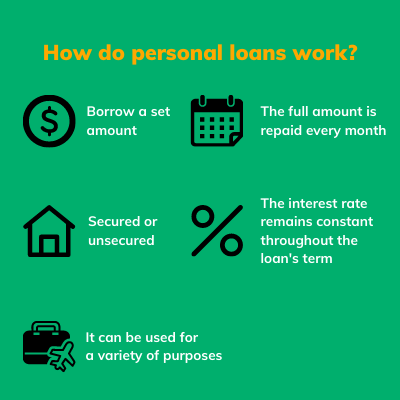

Benefits of a personal car loan: With a personal finance, you can pay off your restorations over a predefined period. Considerations: Once you've paid off a personal loan, that's it.

3 Simple Techniques For Home Renovation Loan

Depending upon which card you have, you may be qualified for generous discounts or incentives and, in some instances, an added warranty on your purchases. Some provincial governments use economic assistance and tax credit histories for environmentally friendly renovations, so you may be able to lower your costs in this manner. You'll have to see to it the economic support and credit ratings are still being provided when the work starts which you meet the eligibility criteria.

Intend to see to it your methods match your passions? Calculate your debt-to-income ratio. Talk with your consultant, who will help you select the service that suits you best. Lastly, formulate a basic budget along with your remodelling budget. By comparing the 2, you'll see exactly how big a monthly financing settlement you can create the improvements.

There are lots of factors to renovate a home, however many house owners do so with the intent of enhancing their home's value should they decide to market in the future. Financing home redesigning tasks with home improvement financings can be a wonderful method to decrease your prices and increase your return on investment (ROI). Right here are a couple of certain benefits of home improvement financing.

The Ultimate Guide To Home Renovation Loan

This might not be a big bargain for smaller remodellings, but when it concerns lasting projects, bank card funding can promptly get expensive. Home remodelling fundings are an even more affordable remedy to utilizing debt cards to pay for the products needed for home improvements. While rate of interest on home restoration fundings vary, they often tend to be within the series of Prime plus 2.00 percent (presently, the prime passion rate is 3.00 percent).

There are also various terms available to suit every job and budget plan. If you need the funds for an one-time task, an equity loan with a fixed regard to 1 to 5 years may be finest suited your requirements. If you require more adaptability, a credit line will certainly permit you to obtain funds as needed without requiring to reapply for credit rating.

In specific provinces, such as Quebec, the give should be incorporated with a provincial program. There are a number of actions to take - home renovation loan. Initially, have your home assessed by an EnerGuide power advisor. You'll receive a record that can direct your improvement choices. Once the work has straight from the source actually been done, your home will be assessed once again to confirm that its power effectiveness has boosted.

Various alternatives are readily available. Conditions use. See the government of Canada web site for more information. Along with government programs, take some time to inspect out what's offered in your province. There could be money just awaiting you to assert it. Right here's an introduction of the main home restoration grants by district.

How Home Renovation Loan can Save You Time, Stress, and Money.

Additionally, all homeowners can relate to the Newfoundland Power and Newfoundland and Labrador Hydro takeCHARGE program for motivations to assist with projects such as upgrading their insulation or mounting a warm recovery ventilator. Homeowners can additionally save when they upgrade to a next-generation thermostat. If you reside in the Northwest Territories, you can get a cash discount on all kind of items that will certainly assist decrease your power intake at home.

If you have a home here, you can be qualified for rebates on high-efficiency heating equipment. Rebates are additionally offered to homeowners that update their insulation. After a home energy assessment is executed. What's more, there are motivations for the acquisition and installment of solar panels and low-interest lendings for renovations that will certainly make your home more power reliable.

The amount of financial assistance you could get varies from under $100 to several thousand bucks, relying on the task. In Quebec, the Rnoclimat program is the only way to access the Canada Greener Residences Grant. best site The Chauffez vert program uses motivations for changing an oil or gas heating unit with a system powered by renewable resource such as electrical energy.

All about Home Renovation Loan

Saskatchewan just provides reward programs for organizations. Keep an eye out for brand-new programs that can likewise apply to house owners.

Restorations can be difficult for households., remember to aspect in all the methods you can i thought about this save cash.

:max_bytes(150000):strip_icc()/whatsapersonalloan-49a4338af74741e7b4dbb0884a191283.jpg)

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)